Learn about child identity theft and effective strategies to protect your children’s digital footprint and personal information.

Learn about child identity theft and effective strategies to protect your children’s digital footprint and personal information.

Child Identity Theft How to Protect Your Kids Online

Hey everyone, let’s talk about something super important but often overlooked: child identity theft. It’s a scary thought, right? Our kids are online more than ever, and while we want them to explore and learn, we also need to shield them from the darker side of the internet. Child identity theft isn’t just about someone stealing their Roblox password; it’s about criminals using their clean slate – their Social Security number, their name, their birthdate – to open credit cards, apply for loans, or even get government benefits. And the worst part? It often goes undetected for years, sometimes until the child is old enough to apply for their first job or college loan. By then, the damage can be massive and a real headache to fix. So, let’s dive into how this happens, why kids are such prime targets, and most importantly, what we can do to protect them.

Why Are Children Prime Targets for Identity Thieves? Understanding the Vulnerability

You might be wondering, why would a criminal target a child? It seems counterintuitive, but it’s actually quite logical from a thief’s perspective. Kids have what adults often don’t: a pristine credit history. They don’t have credit cards, mortgages, or loans, which means their Social Security numbers (SSNs) are essentially blank slates. When a thief uses a child’s SSN, it’s unlikely to trigger any immediate red flags because there’s no existing credit file to monitor. This allows criminals to operate undetected for years, building up debt or committing fraud under the child’s name. Often, the first time anyone realizes something is wrong is when the child applies for their first job, a driver’s license, or college financial aid, only to find their credit is ruined or their identity has been compromised. This delayed discovery makes child identity theft particularly insidious and difficult to resolve.

Common Ways Child Identity Theft Occurs: Recognizing the Risks

Child identity theft can happen in various ways, some of which might surprise you. It’s not always a sophisticated hacker; sometimes, it’s someone closer to home. Here are some of the most common scenarios:

- Data Breaches: Unfortunately, many organizations that hold children’s data – schools, pediatricians’ offices, online gaming platforms, toy companies – can be targets for cyberattacks. If their systems are breached, your child’s personal information could be exposed.

- Phishing Scams and Malware: Kids, especially older ones, might fall victim to phishing emails or malicious links that trick them into revealing personal information or downloading malware that steals data from your devices.

- Social Media Over-sharing: While not direct theft, over-sharing personal details like birthdates, full names, and even school names on social media can provide identity thieves with valuable pieces of information to piece together a profile.

- Family Members or Close Acquaintances: Sadly, a significant percentage of child identity theft is committed by someone known to the family, such as a relative, friend, or even a caregiver. They might have easy access to sensitive documents or information.

- Physical Document Theft: Old-fashioned methods still work. Unsecured mailboxes, discarded documents with personal information, or even a stolen wallet containing a child’s birth certificate or SSN card can lead to identity theft.

- Medical Identity Theft: This is a particularly nasty one. Criminals might use a child’s identity to obtain medical services, prescription drugs, or file fraudulent insurance claims. This can lead to incorrect medical records, which can have serious consequences for the child’s future healthcare.

Essential Strategies to Protect Your Child’s Digital Footprint and Personal Information

Okay, so now that we know the ‘how’ and ‘why,’ let’s get to the ‘what to do.’ Protecting your child’s identity requires a multi-faceted approach, combining vigilance, smart online habits, and utilizing available tools. Here are some key strategies:

Safeguarding Sensitive Documents: Protecting Your Child’s Social Security Number and Birth Certificate

Your child’s Social Security number (SSN) is their golden ticket for identity thieves. Treat it like gold! Keep their SSN card and birth certificate in a secure location, like a locked safe or a safety deposit box. Avoid carrying these documents with you unless absolutely necessary. When asked for your child’s SSN, always question why it’s needed and if there’s an alternative identifier. Many organizations, like schools or sports leagues, might ask for it but often don’t truly require it for their primary function. If they insist, ask about their data security measures. Shred any documents containing your child’s personal information before discarding them. This includes old medical bills, school reports, or anything with their name, address, or birthdate.

Monitoring Your Child’s Credit: Early Detection of Fraudulent Activity

This might sound strange for a child, but it’s a crucial step. Since children don’t typically have credit files, the existence of one is a huge red flag. You can’t proactively monitor a child’s credit in the same way you would an adult’s, but you can check if a credit file has been opened in their name. Contact the three major credit bureaus (Equifax, Experian, and TransUnion) and request a manual search for a credit file associated with your child’s SSN. If a file exists, it’s highly likely that identity theft has occurred. You can then place a credit freeze on that file, which prevents new credit from being opened. Some identity theft protection services also offer child identity monitoring as part of their packages, which can automate this process and alert you to any suspicious activity.

Teaching Digital Literacy and Online Safety: Empowering Your Kids

Education is your first line of defense. Start teaching your children about online safety from a young age, in an age-appropriate manner. Explain the importance of not sharing personal information (full name, address, phone number, school, birthdate) with strangers online. Teach them about strong passwords and why they shouldn’t share them, even with friends. Discuss the dangers of clicking on suspicious links or downloading unknown files. Emphasize that not everyone online is who they say they are. Encourage them to come to you if they encounter anything uncomfortable or suspicious online. Tools like parental control software can help, but open communication is key. Make it a safe space for them to ask questions and report issues without fear of punishment.

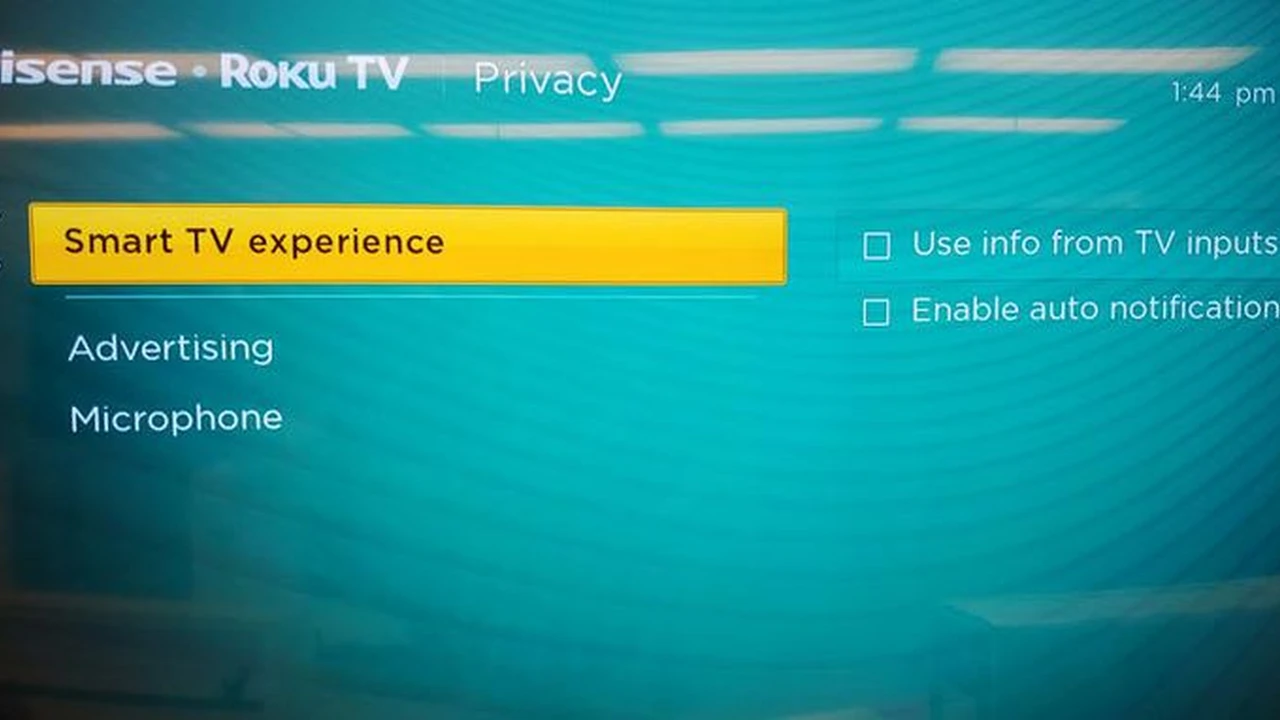

Utilizing Privacy Settings and Parental Controls: Managing Their Digital Footprint

Take advantage of privacy settings on all online platforms your child uses, from social media to gaming apps. Set profiles to private, limit who can see their posts, and disable location sharing. Many apps and devices offer robust parental control features that allow you to manage screen time, restrict access to certain content, and monitor activity. While monitoring should be balanced with trust as they get older, it’s essential for younger children. Regularly review these settings as platforms update and as your child grows. Consider using a family-friendly browser or search engine that filters inappropriate content and offers enhanced privacy features.

Being Cautious with Information Requests: When to Say No

Be skeptical of requests for your child’s personal information. Whether it’s a school form, a doctor’s office, or an online registration, always ask: ‘Why do you need this information?’ and ‘How will it be protected?’ If an organization asks for your child’s SSN for something that doesn’t involve taxes or credit (like a sports league or school photo company), push back. Often, a partial SSN or another identifier will suffice. If you’re uncomfortable, don’t provide it. Remember, you have the right to protect your child’s data.

Securing Your Home Network and Devices: A Foundation for Digital Safety

Your home network is the gateway to the internet for your family. Ensure your Wi-Fi network is secured with a strong, unique password and WPA2 or WPA3 encryption. Regularly update your router’s firmware. Install reputable antivirus and anti-malware software on all family devices (computers, tablets, smartphones) and keep them updated. Teach your children about safe downloading practices and the importance of not disabling security software. Consider using a VPN on your home network or individual devices to encrypt internet traffic, especially if your children are accessing public Wi-Fi networks.

Recommended Identity Theft Protection Services for Children: A Comparative Review

While proactive measures are crucial, sometimes you need an extra layer of protection. Identity theft protection services can offer monitoring, alerts, and recovery assistance specifically tailored for children. Here are a few top contenders, along with their features and typical pricing:

1. Aura Identity Guard for Families

- Key Features: Aura is a powerhouse when it comes to family protection. Their plans typically include comprehensive identity theft protection for adults and children. For kids, this means Social Security number monitoring, dark web monitoring for their personal info, and alerts if their data is found in breaches. They also offer credit monitoring for adults, which can indirectly help spot issues if a child’s SSN is used to open an account linked to a parent. A big plus is their identity theft insurance, which can cover expenses related to recovery, and 24/7 U.S.-based identity restoration specialists who will do the heavy lifting if your child’s identity is compromised. They also often include parental control software and VPN services in their family plans, making it a comprehensive digital safety suite.

- Use Cases: Ideal for families who want an all-in-one solution for both adult and child identity protection, especially those with multiple children. Great for parents who are concerned about their child’s SSN being exposed in data breaches or used fraudulently.

- Pricing: Family plans typically range from $30-$50 per month, depending on the level of coverage and current promotions. They often offer discounts for annual subscriptions.

- Pros: Very comprehensive, excellent identity restoration services, often includes VPN and parental controls, good insurance coverage.

- Cons: Can be pricier than standalone child-only services.

2. IdentityForce UltraSecure+Credit (Family Plan)

- Key Features: IdentityForce is another highly-rated service known for its robust monitoring capabilities. Their family plans extend many of their adult features to children. This includes SSN monitoring, change of address monitoring (a common sign of identity theft), dark web monitoring, and court records monitoring. They also provide alerts for new credit applications or public records associated with your child’s SSN. Like Aura, they offer identity theft insurance and certified resolution specialists to help with recovery. Their alerts are generally very timely and detailed, giving you a heads-up quickly if something suspicious pops up.

- Use Cases: Best for families who prioritize deep monitoring and quick alerts. If you’re particularly worried about new accounts being opened or public records being created in your child’s name, IdentityForce’s detailed monitoring is a strong choice.

- Pricing: Family plans usually fall in the $25-$40 per month range, with annual discounts available.

- Pros: Strong monitoring, timely alerts, good resolution support, comprehensive coverage for various types of fraud.

- Cons: Interface can feel a bit dated compared to some newer services.

3. LifeLock by Norton (Family Plans)

- Key Features: LifeLock is one of the most recognized names in identity theft protection, and their family plans extend their services to children. They offer SSN and credit alerts (if a file exists), dark web monitoring, and alerts for suspicious activity like data breaches or fraudulent use of personal information. A key differentiator for LifeLock is their Million Dollar Protection Package, which includes reimbursement for stolen funds and coverage for expenses. They also have a strong focus on Norton’s cybersecurity suite, often bundling antivirus and VPN services, which adds another layer of protection for your family’s devices.

- Use Cases: Good for families who want a well-known brand with extensive insurance coverage and who might also benefit from bundled cybersecurity tools like antivirus and VPN.

- Pricing: Family plans can range from $20-$60 per month, depending on the tier (Standard, Advantage, Ultimate Plus) and the number of children covered.

- Pros: High brand recognition, substantial insurance coverage, often bundled with Norton security products, good for comprehensive digital protection.

- Cons: Can be more expensive at higher tiers, some users report aggressive marketing.

4. Experian IdentityWorks (Family Plan)

- Key Features: As one of the three major credit bureaus, Experian has a unique advantage in monitoring. Their IdentityWorks family plan offers child identity protection that includes SSN monitoring, dark web surveillance, and alerts if a credit file is opened in your child’s name. They also provide identity theft insurance and dedicated fraud resolution support. What’s particularly useful is their direct access to Experian’s credit data, which can sometimes lead to quicker detection of credit-related fraud. They also offer FICO Score monitoring for adults, which is a nice bonus for parents.

- Use Cases: Excellent for families who want a service directly from a credit bureau, offering potentially faster and more accurate credit-related fraud detection for children.

- Pricing: Family plans typically cost around $20-$30 per month.

- Pros: Direct access to Experian’s credit data, strong SSN monitoring, good resolution support.

- Cons: May not be as comprehensive in non-credit related identity theft monitoring compared to some competitors.

5. IDShield (Family Plan)

- Key Features: IDShield offers comprehensive identity monitoring and restoration services for families. For children, this includes SSN monitoring, dark web surveillance, and alerts for public records or address changes. A standout feature of IDShield is their team of licensed private investigators who handle identity restoration. This means if your child’s identity is stolen, you’re not just getting call center support; you’re getting experienced professionals to work on your behalf to restore their identity. They also offer identity theft insurance and a mobile app for convenient alerts and access to services.

- Use Cases: Best for families who want top-tier identity restoration support from experienced professionals. If the thought of dealing with the aftermath of identity theft is daunting, IDShield’s private investigators can be a huge relief.

- Pricing: Family plans generally range from $25-$40 per month.

- Pros: Excellent identity restoration with private investigators, comprehensive monitoring, good insurance.

- Cons: Less brand recognition than some competitors.

When choosing a service, consider what aspects of protection are most important to you. Do you prioritize comprehensive monitoring, robust restoration, or a good insurance policy? Read reviews, compare features, and look for services that offer a free trial or a money-back guarantee so you can test them out.

What to Do If Your Child’s Identity Is Stolen: A Recovery Action Plan

Even with the best precautions, identity theft can still happen. If you suspect your child’s identity has been compromised, it’s crucial to act quickly. Here’s a step-by-step action plan:

- Contact the Credit Bureaus: Immediately contact Equifax, Experian, and TransUnion. Explain that you suspect child identity theft and request a manual search for a credit file under your child’s SSN. If a file exists, ask them to place a credit freeze on it.

- File a Police Report: File a police report with your local law enforcement agency. This report is essential for disputing fraudulent accounts and can be required by creditors or identity theft protection services. Get a copy of the report.

- Report to the FTC: File a report with the Federal Trade Commission (FTC) at IdentityTheft.gov. The FTC will provide you with an identity theft report and a personalized recovery plan, which can be incredibly helpful.

- Contact Creditors and Companies: If you’ve identified specific fraudulent accounts (e.g., credit cards, utility bills), contact those companies directly. Provide them with your police report and FTC report.

- Notify Other Relevant Institutions: If medical identity theft is suspected, contact your child’s healthcare providers and insurance company. If school records are affected, inform the school.

- Consider an Identity Theft Protection Service: If you don’t already have one, now is a good time to consider subscribing to an identity theft protection service. Their resolution specialists can guide you through the complex recovery process and often handle much of the legwork.

- Keep Detailed Records: Document every phone call, email, and letter. Keep copies of all reports, correspondence, and notes from your conversations. This will be invaluable during the recovery process.

- Monitor Continuously: Even after initial recovery, continue to monitor your child’s information regularly. Identity thieves sometimes try again.

Dealing with child identity theft is a marathon, not a sprint. It can be frustrating and time-consuming, but persistence is key. Remember, you’re advocating for your child’s future financial health and peace of mind.

The Long-Term Impact of Child Identity Theft: Why Prevention Matters

The consequences of child identity theft can be far-reaching and devastating. Beyond the immediate financial fraud, a compromised identity can affect a child’s ability to get student loans, apply for college, secure housing, or even get a job when they become an adult. Imagine your child, excited to start their independent life, only to find their credit score is in the gutter because of debts they never incurred. The emotional toll can also be significant, leading to stress, anxiety, and a feeling of vulnerability. That’s why prevention isn’t just a good idea; it’s a critical responsibility for parents in our increasingly digital world. By taking proactive steps now, you’re not just protecting their data; you’re safeguarding their future.