Plan your digital legacy to protect your online identity and assets after your passing. Secure your digital footprint for the future.

Plan your digital legacy to protect your online identity and assets after your passing. Secure your digital footprint for the future.

Digital Legacy Planning Protecting Your Online Identity After Youre Gone

Hey there! Let’s talk about something that might seem a bit heavy, but it’s super important in our increasingly digital world: what happens to your online life after you’re no longer around? We’re talking about digital legacy planning. It’s not just about your social media profiles; it encompasses everything from your precious photos and emails to your cryptocurrency and online financial accounts. Think of it as estate planning, but for your digital self. It’s about making sure your digital footprint is managed according to your wishes, protecting your privacy, and easing the burden on your loved ones during an already difficult time.

Understanding Your Digital Footprint What Exactly Is a Digital Legacy

Before we dive into planning, let’s get a clear picture of what a ‘digital legacy’ actually entails. It’s far more than just your Facebook page. Your digital footprint is the trail of data you leave behind from all your online activities. This includes:

- Social Media Accounts: Facebook, Instagram, Twitter, LinkedIn, TikTok, etc.

- Email Accounts: Gmail, Outlook, Yahoo, etc. These often serve as keys to other accounts.

- Cloud Storage: Google Drive, Dropbox, iCloud, OneDrive, where you store documents, photos, and videos.

- Online Financial Accounts: Banking, investment platforms, PayPal, Venmo, cryptocurrency wallets.

- E-commerce Accounts: Amazon, eBay, Etsy, where you might have stored payment information or have digital assets like gift cards.

- Digital Media Libraries: iTunes, Spotify, Kindle, Steam, Netflix, containing purchased music, books, games, and subscriptions.

- Websites and Blogs: If you own or manage any personal or professional websites.

- Domain Names: Any website domains you’ve registered.

- Online Photo Albums: Flickr, Google Photos, Shutterfly, holding countless memories.

- Loyalty Programs and Rewards: Airline miles, hotel points, retail rewards.

Essentially, anything you’ve created, stored, or accessed online forms part of your digital legacy. Without a plan, these assets can become inaccessible, fall into the wrong hands, or simply disappear, causing distress or even financial loss for your family.

Why Digital Legacy Planning Is Crucial Protecting Your Digital Assets and Privacy

You might be thinking, ‘Do I really need to plan for this?’ The short answer is a resounding yes! Here’s why it’s so crucial:

Preventing Identity Theft and Fraud After Death

Believe it or not, identity theft doesn’t stop when someone passes away. Deceased individuals are often targets for fraudsters who exploit inactive accounts or lack of oversight. By planning your digital legacy, you can ensure accounts are properly closed or transferred, significantly reducing the risk of post-mortem identity theft and financial fraud.

Preserving Memories and Sentimental Value

For many, digital photos, videos, and messages hold immense sentimental value. Without a plan, these precious memories might be lost forever if your loved ones can’t access your cloud storage or social media. A digital legacy plan ensures these memories can be preserved, shared, or archived as you wish.

Managing Financial and Tangible Digital Assets

From cryptocurrency holdings to online investment accounts, many financial assets now exist purely in the digital realm. If your family doesn’t know these exist or how to access them, they could be lost. Similarly, digital assets like domain names, e-books, or software licenses might have monetary value or ongoing utility that needs to be managed.

Easing the Burden on Loved Ones During Grief

Losing someone is incredibly difficult. Imagine adding the stress of trying to guess passwords, navigate complex online platforms, and deal with customer service departments just to close an email account. A clear digital legacy plan provides your family with the necessary information and instructions, allowing them to focus on grieving rather than digital detective work.

Controlling Your Online Narrative and Reputation

You have a right to control how you’re remembered. A digital legacy plan allows you to specify what happens to your social media profiles – whether they’re memorialized, deleted, or managed by a designated person. This helps maintain your online reputation and ensures your digital presence reflects your wishes.

Key Components of an Effective Digital Legacy Plan What to Include

So, what goes into a solid digital legacy plan? It’s more than just a list of passwords. Here are the essential elements:

Inventory of All Digital Accounts and Assets

This is your master list. Document every single online account you have. For each account, include:

- The website or platform name (e.g., Facebook, Gmail, Bank of America).

- Your username or email associated with the account.

- A note on whether it’s a personal, financial, or social account.

- Instructions for what you want to happen to the account (delete, memorialize, transfer, etc.).

- Any specific notes or messages for that account.

Pro Tip: Don’t write down your actual passwords directly on this list if it’s stored physically. Instead, refer to a secure password manager where your passwords are encrypted.

Designating a Digital Executor or Trusted Contact

Just like you appoint an executor for your will, you should designate a ‘digital executor’ or trusted contact. This person will be responsible for carrying out your digital wishes. They should be someone you trust implicitly, who is tech-savvy enough to navigate online platforms, and who understands your intentions. Make sure they know where to find your digital legacy plan and how to access any necessary tools.

Instructions for Each Account Type Social Media Email and Financial

Be specific about what you want for different types of accounts:

- Social Media: Do you want your Facebook to be memorialized? Do you want your Instagram deleted? Who should have access to post a final message?

- Email: Should your email accounts be closed? Should someone be able to access them for a period to tie up loose ends?

- Financial: Provide clear instructions for accessing and managing online banking, investment, and cryptocurrency accounts. This is where a secure password manager becomes critical.

- Cloud Storage: Specify if photos and documents should be downloaded, shared with specific family members, or deleted.

Access Information and Password Management Strategies

This is the trickiest part due to security concerns. You should never write down your passwords in an easily accessible, unencrypted format. Instead, use a reputable password manager. We’ll discuss some great options shortly. Your digital legacy plan should include instructions on how your digital executor can access your password manager.

Legal Documents and Authorizations

Depending on your jurisdiction, you might need to include specific legal language in your will or create a separate digital power of attorney. This grants your digital executor the legal authority to access and manage your accounts, as many terms of service agreements prohibit third-party access. Consult with an estate planning attorney to ensure your plan is legally sound.

Tools and Services for Digital Legacy Planning Making It Easier

Thankfully, you don’t have to do all this manually. Several tools and services can help you organize and manage your digital legacy. Here are some top recommendations:

Password Managers The Foundation of Digital Security

A robust password manager is absolutely essential for digital legacy planning. It securely stores all your usernames and passwords in an encrypted vault, accessible only with a master password. Many also offer secure sharing features for trusted contacts.

Recommended Password Managers:

- LastPass:

- Features: Excellent for individuals and families. Offers secure notes, form filling, and a ‘Emergency Access’ feature where you can grant trusted contacts access to your vault after a waiting period.

- Use Case: Ideal for users who want a comprehensive, user-friendly solution with a strong focus on emergency access for legacy planning.

- Comparison: Very popular, good balance of features and ease of use.

- Pricing: Free tier available with basic features. Premium plans start around $3/month for individuals, $4/month for families.

- 1Password:

- Features: Known for its strong security, intuitive interface, and ‘Travel Mode’ for added privacy. Offers secure document storage and a ‘Families’ plan that allows for shared vaults.

- Use Case: Great for users who prioritize top-tier security and a clean, organized interface. The family plan is excellent for sharing specific items with trusted family members.

- Comparison: Often cited as one of the most secure and feature-rich options.

- Pricing: Individual plans start around $3/month, Family plans around $5/month.

- Dashlane:

- Features: Includes a built-in VPN (on premium plans), dark web monitoring, and a user-friendly interface. Offers a ‘Legacy’ feature to designate a beneficiary.

- Use Case: Good for users who want an all-in-one security solution that includes VPN and dark web monitoring alongside password management.

- Comparison: Strong feature set, but the VPN might be overkill if you already have one.

- Pricing: Free tier available. Premium plans start around $3.99/month.

How to Integrate with Legacy Planning: Store your master password for the chosen password manager in a secure, physical location (e.g., a sealed envelope with your will) and inform your digital executor of its location and how to access it. Utilize the emergency access features offered by these services.

Digital Legacy Services and Platforms Specialized Solutions

Beyond password managers, some services are specifically designed for digital legacy planning.

- Everplans:

- Features: A comprehensive digital vault for all your important information, including legal documents, financial accounts, medical information, and digital assets. It guides you through the process of organizing everything and allows you to designate deputies who can access your plan when needed.

- Use Case: Best for individuals who want a holistic approach to end-of-life planning, covering both digital and traditional assets.

- Comparison: More comprehensive than just a password manager, acting as a central hub for all critical life information.

- Pricing: Subscription-based, typically around $75/year.

- Google Inactive Account Manager:

- Features: This free tool from Google allows you to decide what happens to your Google account (Gmail, Photos, Drive, YouTube, etc.) if it becomes inactive for a specified period. You can choose to have your data deleted or shared with up to 10 trusted contacts.

- Use Case: Essential for anyone with a Google account. It’s a simple, effective way to manage a significant portion of your digital life.

- Comparison: Specific to Google accounts, but given Google’s pervasive presence, it’s a must-use.

- Pricing: Free.

- Facebook Legacy Contact:

- Features: Facebook allows you to designate a ‘legacy contact’ who can manage your memorialized account after you pass away. They can respond to new friend requests, write a pinned post, and update your profile picture, but cannot log into your account or view private messages. You can also choose to have your account permanently deleted.

- Use Case: Crucial for anyone with an active Facebook presence who wants to control their post-mortem profile.

- Comparison: Specific to Facebook, but a vital component for social media legacy.

- Pricing: Free.

Traditional Estate Planning Software and Services

While not exclusively digital, many modern estate planning tools now incorporate digital assets.

- LegalZoom / Rocket Lawyer:

- Features: These online legal services allow you to create wills, trusts, and power of attorney documents. They often include sections or guidance on how to address digital assets within these legal frameworks.

- Use Case: For those who want to create legally binding documents that cover both traditional and digital assets.

- Comparison: Provides legal validity that standalone digital legacy services might not.

- Pricing: Varies depending on the documents and services, typically ranging from $80 to several hundred dollars for a will.

Step-by-Step Guide to Creating Your Digital Legacy Plan Getting Started

Feeling overwhelmed? Don’t be! Here’s a practical, step-by-step approach to building your digital legacy plan:

Step 1 Conduct a Digital Audit Inventory Your Accounts

This is the most time-consuming but crucial step. Go through your devices, browsers, and email accounts. Make a list of every online service you use. Think about:

- Websites you log into regularly.

- Apps on your phone and tablet.

- Email accounts (personal, work, old ones).

- Cloud storage services.

- Online shopping sites.

- Streaming services.

- Gaming platforms.

- Cryptocurrency exchanges and wallets.

Don’t forget those obscure accounts you signed up for years ago!

Step 2 Document Your Wishes For Each Digital Asset

For each item on your inventory, decide what you want to happen:

- Delete: For accounts you no longer want active.

- Memorialize: For social media profiles you want to remain as a tribute.

- Transfer: For assets like domain names or valuable digital collections.

- Archive: For photos or documents you want saved and given to specific people.

- Access for Closure: For email or financial accounts that need to be accessed temporarily to tie up loose ends.

Write down these instructions clearly.

Step 3 Choose Your Digital Executor and Discuss Your Plan

Select a trustworthy individual. Have an open and honest conversation with them about your wishes. Explain the importance of the role and where they can find all the necessary information. Ensure they are comfortable with the responsibility.

Step 4 Secure Your Access Information Using a Password Manager

Implement a strong password manager (like LastPass, 1Password, or Dashlane). Store all your login credentials there. Utilize the emergency access features if available. Crucially, provide your digital executor with instructions on how to access this password manager (e.g., the master password in a sealed envelope, or through the service’s emergency access feature).

Step 5 Incorporate Digital Assets into Your Legal Will

Consult with an estate planning attorney. They can help you draft or update your will to include specific provisions for your digital assets and formally appoint your digital executor. This provides legal backing for your wishes and can prevent disputes or access issues.

Step 6 Regularly Review and Update Your Plan

Your digital life is constantly evolving. New accounts are created, old ones are deleted, and your wishes might change. Make it a habit to review and update your digital legacy plan at least once a year, or whenever there’s a significant change in your online presence or personal circumstances.

Common Challenges and How to Overcome Them Navigating the Digital Afterlife

Digital legacy planning isn’t without its hurdles. Here’s how to tackle some common challenges:

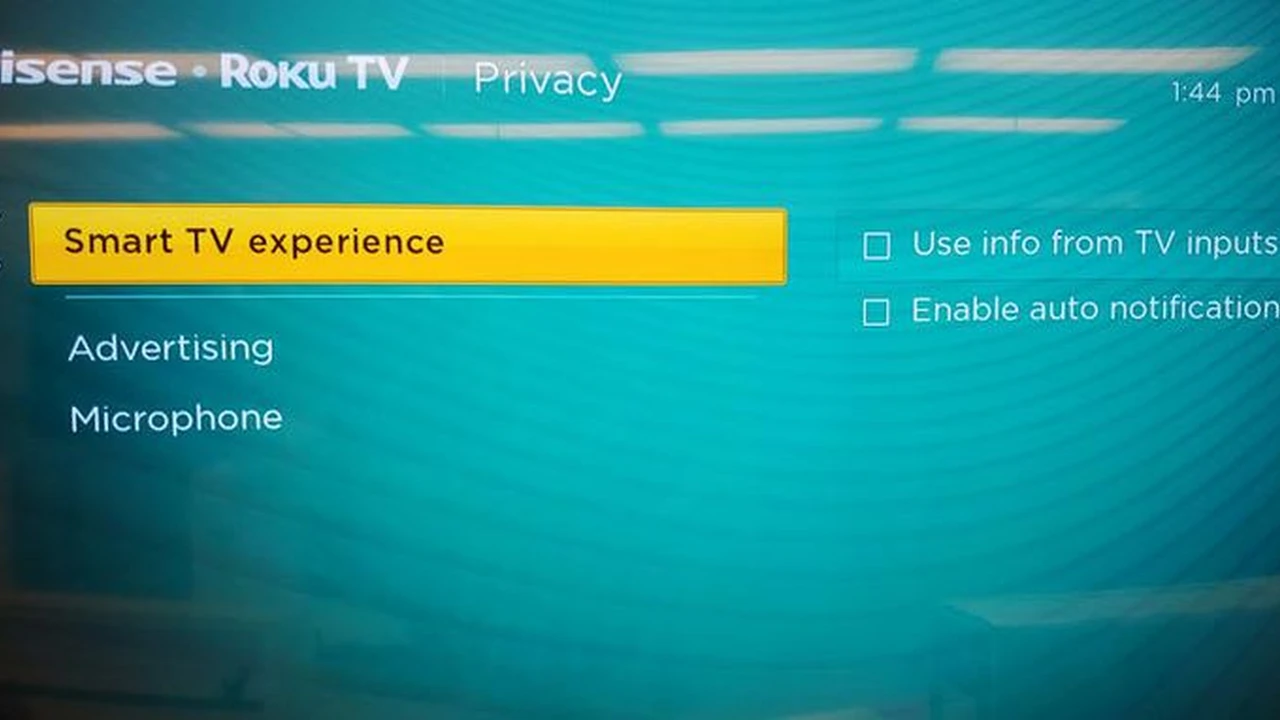

Privacy Concerns and Data Security

The biggest concern is often how to grant access without compromising security. This is where a reputable password manager with emergency access features shines. Avoid sharing your master password directly; instead, use the built-in mechanisms of these services or secure physical storage for critical access keys.

Terms of Service Agreements

Many online platforms have terms of service that prohibit sharing login credentials or granting third-party access. This is why legal authorization (like a digital power of attorney or specific language in your will) is so important. It gives your digital executor the legal standing to interact with these companies.

Keeping Up with Evolving Digital Assets

The digital landscape changes rapidly. What’s popular today might be obsolete tomorrow. Regular reviews of your digital legacy plan are essential to ensure it remains current and comprehensive.

Emotional Aspects Discussing Death and Digital Afterlife

It’s tough to talk about death, and even tougher to discuss your digital afterlife. However, having these conversations with your chosen digital executor and family members is vital. It ensures everyone is on the same page and understands your wishes, making the process smoother for them later on.

The Future of Digital Legacy Planning Innovations and Trends

As our lives become even more intertwined with technology, digital legacy planning will continue to evolve. We might see:

- More Integrated Platform Features: Social media and other platforms may offer more robust and user-friendly legacy management tools.

- AI-Powered Digital Assistants: AI could potentially help organize digital assets and even draft initial legacy plans based on user activity.

- Blockchain for Digital Asset Management: Blockchain technology could offer secure, transparent, and immutable ways to manage and transfer digital assets, including cryptocurrency and NFTs.

- Standardized Legal Frameworks: Governments may develop more standardized laws regarding digital assets and post-mortem access, simplifying the legal aspects.

For now, the best approach is to be proactive, use the tools available, and communicate your wishes clearly. Your digital legacy is a significant part of your overall life story, and planning for it ensures that story continues to be told and managed exactly as you intend.

Taking the time to plan your digital legacy is one of the most thoughtful things you can do for yourself and your loved ones. It provides peace of mind, protects your assets, and preserves your memories. So, don’t put it off – start building your digital legacy plan today!